Indicators on Hard Money Georgia You Need To Know

Wiki Article

Some Known Incorrect Statements About Hard Money Georgia

Table of ContentsHard Money Georgia for DummiesThe Best Strategy To Use For Hard Money GeorgiaThe Ultimate Guide To Hard Money GeorgiaHard Money Georgia Things To Know Before You Get ThisHard Money Georgia Fundamentals Explained

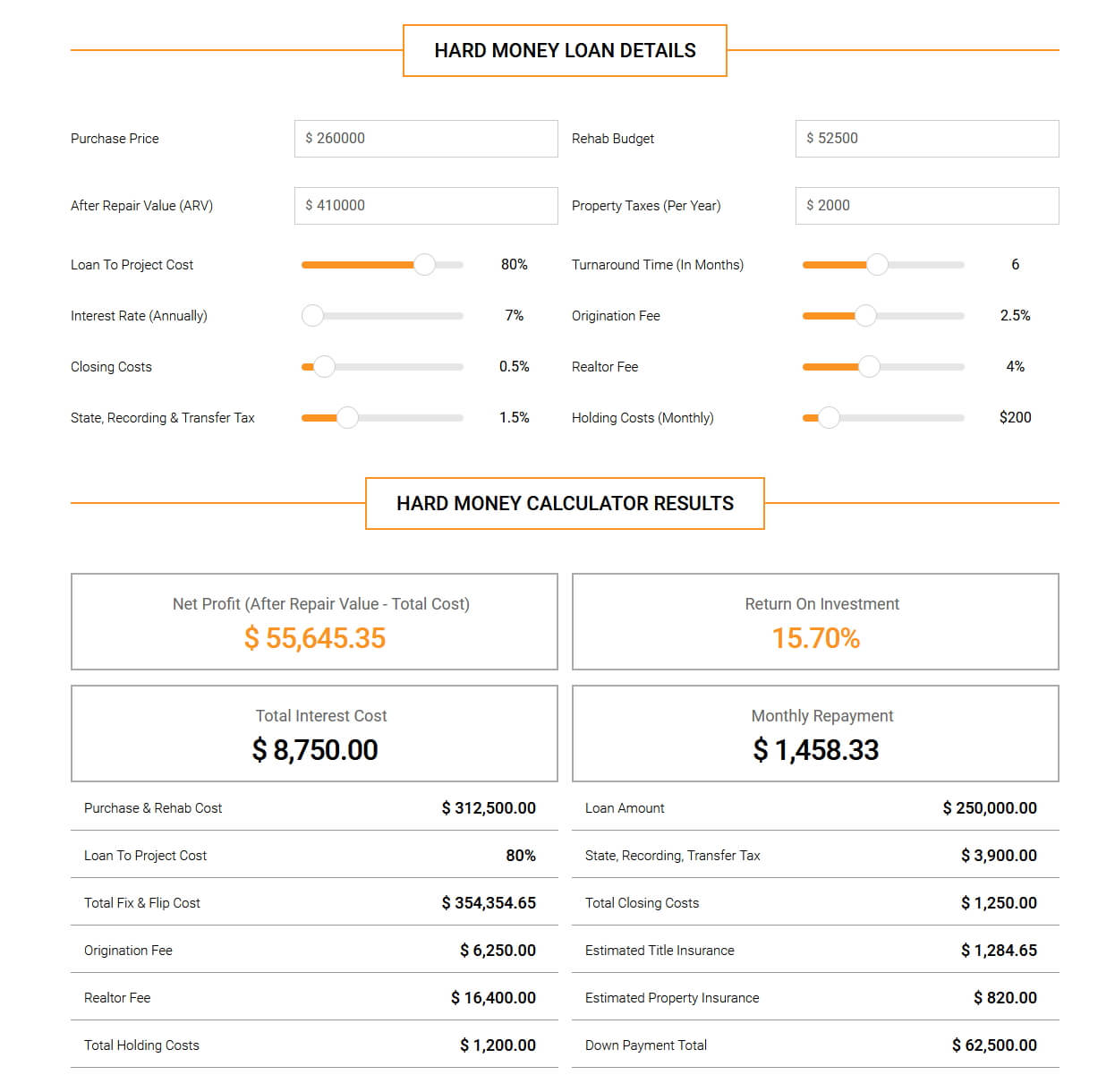

A specific capital barrier is still required. Difficult cash loans, occasionally described as swing loan, are temporary loaning tools that investor can use to finance a financial investment task. This kind of lending is usually a tool for residence flippers or genuine estate developers whose goal is to restore or create a residential or commercial property, then market it for an earnings. There are 2 key drawbacks to think about: Tough cash fundings are practical, yet investors pay a rate for borrowing this means. The rate can be up to 10 percent factors higher than for a traditional funding.

As a result, these car loans include much shorter payment terms than conventional mortgage loans. When selecting a difficult cash lender, it's crucial to have a clear idea of exactly how quickly the residential or commercial property will certainly end up being successful to guarantee that you'll be able to pay back the lending in a timely fashion.

Some Known Details About Hard Money Georgia

Once more, lenders may allow investors a bit of freedom right here.Difficult cash fundings are a great suitable for affluent capitalists that need to get funding for an investment residential or commercial property rapidly, without any of the red tape that goes along with bank financing. When assessing tough money loan providers, pay attention to the charges, rates of interest, and lending terms. If you wind up paying as well a lot for a tough money financing or cut the settlement duration too short, that can affect exactly how successful your realty endeavor is in the lengthy run.

If you're seeking to acquire a home to flip or as a rental home, it can be challenging to obtain a typical home loan. If your credit rating isn't where a traditional loan provider would like it or you require cash money faster than a loan provider has the ability to provide it, you can be unfortunate.

The Facts About Hard Money Georgia Uncovered

Difficult cash car loans are temporary secured financings that utilize the building you're acquiring as collateral. You won't find one from your bank: Hard money financings are offered by different lenders such as specific capitalists and also private firms, who usually neglect sub-par credit history scores and also other financial aspects and also instead base their choice on the building to be collateralized (hard money georgia).

Tough cash financings offer a number of benefits for customers. These include: From beginning to complete, a hard cash finance might take simply a couple of days.

While tough money financings come with benefits, a debtor you could try here should additionally consider the dangers - hard money georgia. Among them are: Tough money loan providers commonly charge a higher rate of interest price since they're thinking even more threat than a conventional loan provider would certainly.

The 9-Minute Rule for Hard Money Georgia

You're unsure whether you can manage to repay the hard cash car loan in a brief period of time. You've obtained a solid credit score and also should have the ability to certify for a conventional finance that likely brings a reduced interest rate. Alternatives to difficult cash finances consist of traditional home mortgages, house equity lendings, friends-and-family lendings or financing from the residential property's seller.

Excitement About Hard Money Georgia

It is very important to take into consideration variables such as the lending institution's online reputation as well as interest prices. You may ask a trusted realty representative or useful source a fellow home flipper for referrals. Once you have actually toenailed down the appropriate tough cash lender, be prepared to: Think of the deposit, which typically is heftier than the down repayment for a conventional home loan Gather the required documents, such as evidence of earnings Possibly employ an attorney to go over the terms of the finance after you've been authorized Map out a method for repaying the funding Simply as with any kind of finance, assess the pros and disadvantages of a difficult cash lending before you commit to loaning.No matter what kind of lending you select, it's possibly an excellent concept to check your complimentary credit rating and totally free credit rating record with Experian to see where your finances stand.

When you listen to words "hard money financing" (or "exclusive money funding") what's the initial point that undergoes your mind? Shady-looking loan providers that conduct their service in dark streets as well as cost overpriced rate of interest? In prior years, some negative apples tarnished the difficult cash lending market when a couple of predative lending institutions were attempting to "loan-to-own", providing extremely high-risk car loans to consumers utilizing realty as security and meaning to confiscate on the residential properties.

Report this wiki page